The Behavioral Moat: Investing in Enduring Human Nature

The Behavioral Moat: Investing in Enduring Human Nature

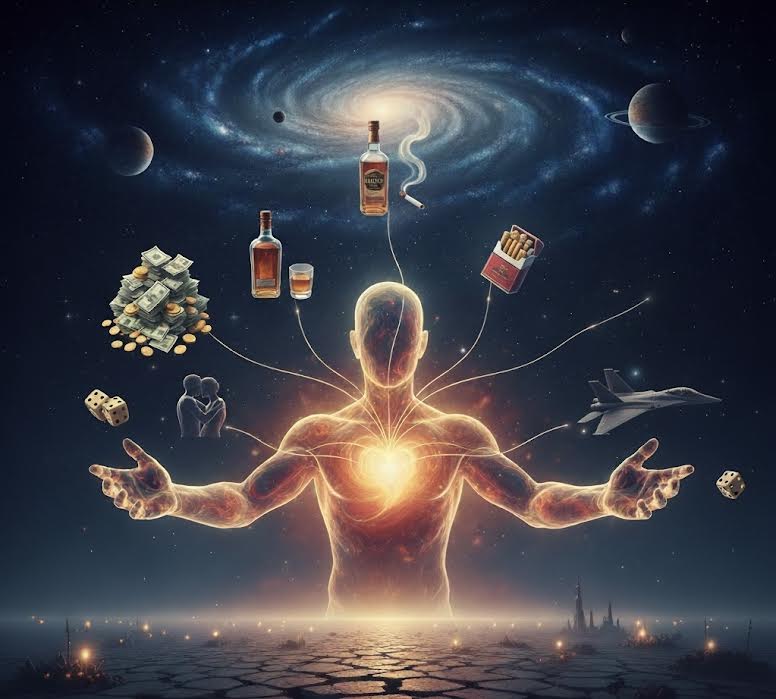

One of the most powerful and enduring rules in long-term investing is to identify companies with a built-in moat—a structural advantage that protects market share and profitability. The deepest moats are often those fundamentally tied to enduring human nature. This strategy involves looking past short-term trends to assess whether a company is positioned for long-term relevance because its product or service aligns with an inherent, non-negotiable human desire, fear, or vice.

While this approach can lead to immense profitability, it often involves looking at sectors that are viewed in a negative or controversial light. However, the staying power of these companies is often undeniable, and the market's ethical disapproval can sometimes create a favorable discount or an ideal entry point for patient investors.

Exploiting Behavioral Moats: The Vice Industries

The most straightforward examples of behavioral moats are found in companies associated with addiction—primarily alcohol, tobacco, and gambling. These industries benefit from a fiercely loyal, inelastic customer base, as their products often interact directly with the human dopamine system, intertwining with people's daily lives.

While societal shifts and regulatory pressure are constant factors, the resilience of these segments is historic. For example, British American Tobacco (BTI) has historically offered investors strong cash flow and high dividend yields, illustrating the compounding power of this deep-seated demand. Similarly, while direct gambling operators can face valuation volatility, a company like VICI Properties (VICI), which leases the land and assets where major casinos operate, offers undeniable, durable real estate exposure to this persistent consumer behavior. Recent market downturns in prominent alcohol companies like Constellation Brands (STZ), Diageo (DEO), and Molson Coors Beverage (TAP) have been viewed by some as opportunities to accumulate assets tied to leading spirit and beer portfolios with strong global brand equity.

The Inevitability of Conflict: Defense and Security

Another undeniable aspect of human nature is the constant potential for conflict. As long as individual liberties and differing ideologies persist, the concept of a perfectly peaceful, utopian world remains impossible. The basis of this enduring investment opportunity lies in the concept of societal entropy: as long as freedom allows for divergent human action, disorder and conflict will inevitably surface. This dynamic extends to international relations, where nations are often directed by powerful leaders or groups whose strategic interactions mirror the conflicts seen in individual human exchanges. Consequently, the potential for international conflict remains a constant, driving a global arms race.

The aerospace and defense sector offers a powerful investment thesis based on geopolitical inevitability. Leading U.S. defense contractors like Lockheed Martin (LMT), Raytheon Technologies (RTX), L3Harris Technologies (LHX), and General Dynamics (GD) are consistently essential in protecting national interests. In the digital realm, cybersecurity firms like Palo Alto Networks (PANW) and F5 Networks (F5) address a growing, non-discretionary corporate and governmental need. Recent, significant increases in military spending across European nations reflect a strategic realignment and perceived uncertainty regarding global protective alliances, further accelerating demand across this sector, even if finding ideal entry points has become challenging due to explosive stock growth.

The Desire for Financial Safety: The U.S. Insurance Complex

The profound human need for safety and financial security forms the foundation of the U.S. insurance complex. In a nation where medical costs are notoriously high, people are driven to protect their financial futures against catastrophic events.

The structural dynamics of the U.S. healthcare system, where an unexpected medical emergency can erase a lifetime of financial stability, make health insurance a virtually non-negotiable expense. This, coupled with rising comorbidity rates, suggests a lasting, essential role for health insurers, including major publicly traded players like UnitedHealth Group (UNH), Cigna (CI), Elevance Health (ELV), CVS Health, which owns Aetna (CVS), and Humana (HUM). This deep-rooted fear of financial ruin and the corresponding desire for protection provide a robust, resilient customer base that often insulates the insurance sector from broader economic volatility.

Conclusion

The strategy of investing based on human nature centers on identifying businesses that hold dominant positions in their fields because they are fundamentally entwined with permanent human behaviors. Whether satisfying a powerful vice, mitigating an existential threat, or fulfilling the essential need for security, these companies possess moats that are deeper than simple technology or brand loyalty. By focusing on these core psychological and societal drivers, investors can position their portfolios for compounding returns that transcend temporary market cycles.